Our Process

Managed Futures: An Introduction

Download a PDF of our Managed Futures education guide.

Perhaps the most critical and overlooked factor when investing in alternatives is manager selection.

We believe the best way for investors to implement an alternative investment strategy is a multi-manager approach. Unlike single manager funds that rely on one system to generate returns, a multi-manager fund spreads investor assets across several carefully selected managers in an attempt to better diversify risk.

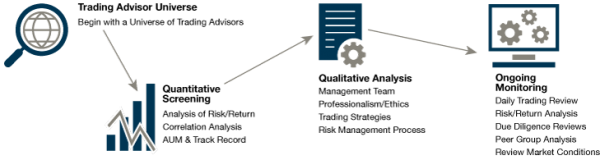

Selecting and monitoring alternative investment managers requires experience, discipline and focus. Of the thousands of futures trading advisors available, only a small number fit our rigorous selection criteria.

Read on to learn more about our research driven process.

Fund Development

Since 1989, Steben & Company has focused on just one thing: alternative investments. We feel that staying focused can produce better results over the long term. While some providers boast product line-ups of hundreds of funds, we manage just a handful. Our oldest fund has been continuously operating since 1990.

Steben & Company’s strength is our ability to conduct global manager due diligence, selection, allocation and monitoring. By developing investment products that combine what we believe are the best managers from around the world, and then consistently monitoring and evaluating their performance, we can deliver the types of products that investors seek when allocating to alternative investments.

Fund Manager Selection

For Steben & Company's managed futures funds, we monitor every trade that occurs in the funds, every day. Steben was among the first to do this. Our monitoring systems have been built and refined over the course of more than 30 years.

We also seek transparency in our products. Our investment and operational due diligence processes are extremely detailed and we employ third party risk monitoring services to help monitor exposure levels within the funds.

Performance Evaluation Adjustment

At Steben & Company, we believe that due diligence does not end with the selection of managers. Our ongoing performance evaluation process is rigorous and systematic. We utilize all the tools available to us, both proprietary and third party, to continuously analyze manager performance and monitor risk.

Our research team regularly reviews the managers in our funds to ensure they maintain the style, performance, and risk characteristics found during the selection process. Our team also engages in regular conference calls with each manager, requires written performance updates, and has face to face meetings at least annually to re-review the firm’s operations and personnel.

Any material changes identified by the research team will be reviewed by the Investment Committee and may result in the manager losing their mandate.

| Ongoing Monitoring Processes |

| Managed Accounts and Third Party Risk Monitoring |

| Daily and Monthly Risk Analysis • Risk levels, margin-to-equity and position concentrations • Monitor for style drift |

| Regular Manager Contact • Monthly update discussions (more often as needed) • Annual on-site due diligence reviews |

| Peer Group Analysis • Check that managers remain competitive versus peers |

Transparency and Compliance

A critical factor when considering an alternative investment provider is their history and approach to transparency and compliance.

Steben & Company was a pioneer in constructing managed futures funds that allow for daily monitoring of all trades executed and positions maintained in our Funds.

Steben & Company is registered with the SEC and CFTC, and is a member of the NFA. Our funds are also subject to generally accepted accounting principles (GAAP) and provide audited financial statements on a regular basis.